Stablecoin issuer Circle has signed an agreement to acquire the Interop Labs team and its proprietary technology, bringing a core contributor to the Axelar Network into its infrastructure business.

The deal, expected to close in early 2026, covers Interop Labs’ personnel and proprietary intellectual property, while the Axelar Network, its foundation and the AXL token will remain independent and governed by the community.

Interop Labs is the initial developer of the Axelar Network, a decentralized interoperability network that supports crosschain messaging and asset transfers between blockchains. Circle said the team’s technology will be integrated into Circle’s Arc blockchain and Cross-Chain Transfer Protocol (CCTP).

Another Axelar contributor, Common Prefix, will take over Interop Labs’ previous development responsibilities to maintain continuity on the open-source network.

According to Circle, the acquisition is expected to speed up interoperability for assets issued on Arc, enhance developer tools for multichain applications, and support the development of Circle-built products. The terms of the deal were not disclosed.

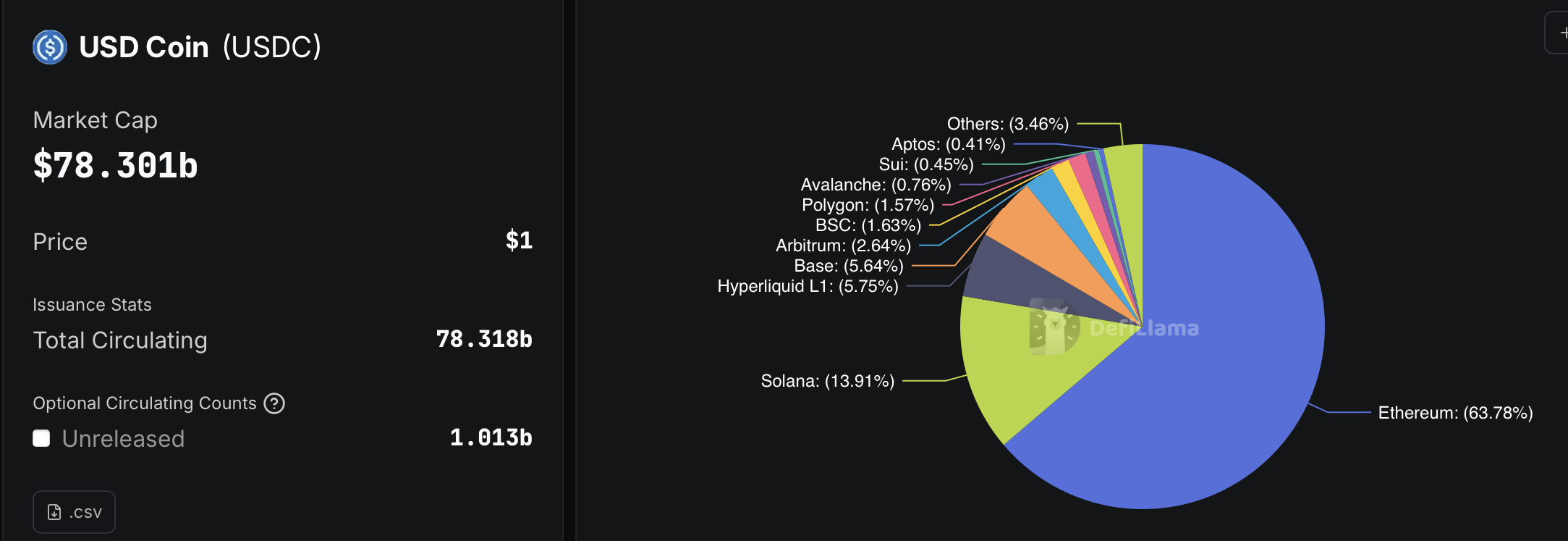

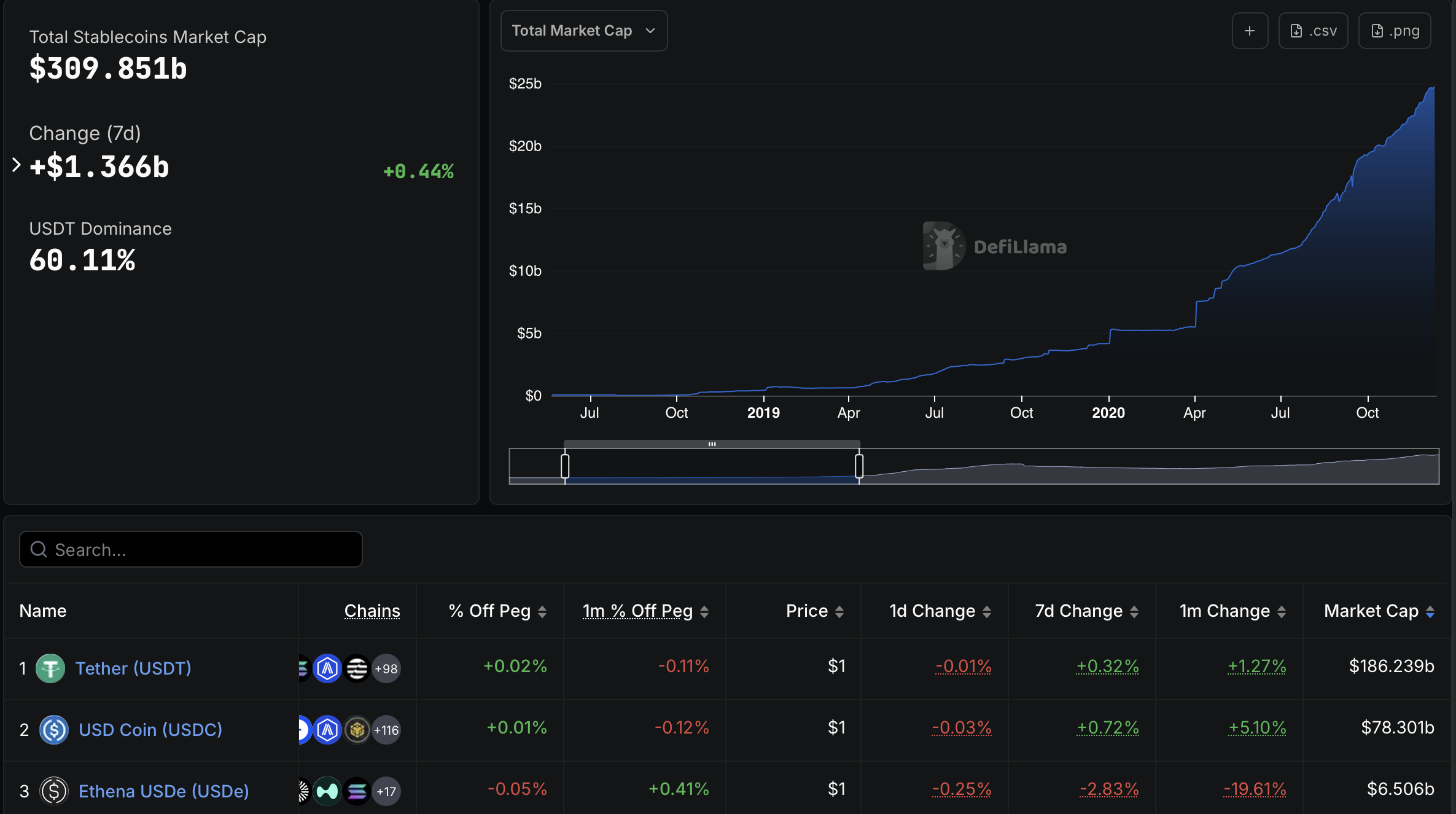

Circle issues USDC (USDC), the second-largest stablecoin by market capitalization, accounting for roughly 25% of the $310 billion global stablecoin market, according to DefiLlama data.

In January, Circle acquired Hashnote, the issuer of the tokenized money market fund US Yield Coin, bringing one of the largest yield-bearing real-world asset products into its stablecoin and infrastructure business.

Related: Paxos, Ripple, Circle and others secure US trust bank approvals

Stablecoin issuers make acquisitions in 2025

Stablecoin issuers have increasingly used acquisitions in 2025 to expand their businesses.

In November, Paxos acquired institutional crypto wallet provider Fordefi in a deal valued at more than $100 million, according to Fortune. Paxos, the issuer of Pax Dollar (USDP) and PayPal’s USD (PYUSD) stablecoin, said the acquisition strengthens its custody and transaction infrastructure for stablecoin issuance, asset tokenization and onchain payments.

Tether, the dominant stablecoin issuer behind the USDt (USDT) token, has used its balance sheet to acquire minority stakes and strategic positions across traditional asset businesses.

In June, it acquired a roughly 32% stake in Canada-listed gold royalty company Elemental Altus Royalties for about $89 million. In November, Tether Investments acquired a minority stake in precious metals company Versamet Royalties, purchasing about 11.8 million common shares through a private agreement with an existing shareholder.

Tether has tried to push beyond finance into sports, submitting a binding all-cash offer on Dec. 12 to acquire Exor’s 65.4% controlling stake in Italy’s Juventus Football Club, a bid that the Agnelli family’s holding company later said its board unanimously rejected.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops